“Digital” is often coupled with “transformation,” and one area where its transformative powers are increasingly manifest is in finance and money. In this ongoing series, we will report on the US Congress’s efforts to formulate digital assets policy. We use the term “digital assets” rather than digital money because it is a broader term that better captures the ambiguous status of digitization’s intersection with the world of payments, money, commodities and securities.

We aim to provide the reader with all the salient points in this contentious policy arena while circumventing the distractions of political grandstanding. We will address the state of negotiations, sticking points, and proposed solutions, as well as shed light on some relevant areas not getting enough attention. Given the cross-cutting and fast-paced nature of these discussions, we welcome comments, suggestions, and corrections to omissions and hope for a healthy discussion in the comments section.

In this first entry, we provide an overview of what stablecoins are, the reason for their existence, and raise serious questions about the validity of Tether’s global operations.

What are stablecoins?

Stablecoins are digital tokens that represent assets recorded on a blockchain. As digital tokens, they maintain a stable net asset value to a non-digital reference, which can be anything from fiat currencies like the US dollar to commodities like gold.

Stabilizing a token’s value is achieved through a mechanism colloquially known as “pegging,” of which three variants exist: algorithmic, collateralized, and custodial. The relevant version in this debate[1] involves custodial stablecoins, more often referred to as “reserve-backed” of which Tether’s USDT token and Circle’s USD Coin are prime candidates.

When I purchase a single USDC token with a US dollar in the bank, Circle’s asset side of the balance sheet (USD Coin’s operator) grows by $1 as a USD Coin is “minted” to me. The operation also increases the size of Circle’s liabilities on the balance sheet by $1. The system is supposed to be initially seeded by capital investments. These reserve-backed stablecoins have been likened to money market mutual funds where IOUs are issued against reserve assets. The rules of the game are simple, the fund must remain solvent and it must comply with Know-Your-Customer (KYC) rules of finance.

Transparency over a platform’s reserve structure is key to understanding the soundness of a stablecoin operator’s business model. A sound portfolio should be independently verified by third-party auditors while balancing highly liquid assets with less liquid assets. The balance would allow for a backstop against run risks while maintaining sustainable margins of revenue for the operator. Operators rely on large capitalization which increases a platform’s network effects and may even allow an operator to hold surplus reserves.

How do stablecoin platforms make money?

A stablecoin issuer typically makes money by charging transaction fees for the creation, redemption, and/or use of their stablecoins, the “take rate.” These fees are much more competitive than traditional banks and automated clearinghouses running 60-year-old COBOL-based systems. With their secure, instant settlements powered by software, networking, and cryptography, stablecoins run a more efficient backend infrastructure, allowing for more access to financial services for small depositors. In other words, users can’t be too poor to hold USDC on Coinbase whereas banks will charge small depositors if their balances drop below a certain threshold. The administrative burden of running their accounts, in that case, would be greater than the value derived from their deposits.

In addition to transaction fees, stablecoin issuers generate revenue by investing some of the funds used to back their stablecoins in interest-bearing assets such as short-term treasury bills, bonds, or other low-risk securities.

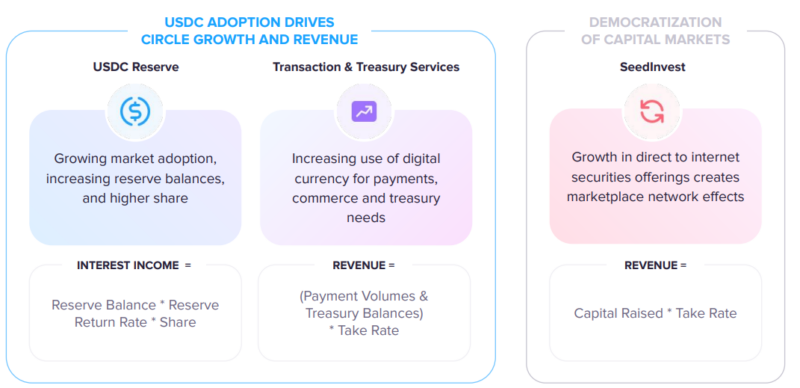

Circle, the operator of USDC can also invest their clients’ balances and, like a traditional bank depositor, return yield that is shared between the user and operator as figure 2 below shows.[2] As Circle’s market capitalization increases, its ability to interoperate with financial services such as smart contracts, or “internet securities,” given a permissive regulatory environment, will prove a complementary positive-feedback loop.

Figure 1: USD Coin business model (taken from an Investor presentation)

It is worth mentioning that Center, which is the consortium joining Circle and Coinbase, is also building an identity ecosystem called Verite. This identity framework is aimed at reducing compliance costs and enhancing privacy by unbundling Personally Identifiable Information (PII) from their associated KYC metadata. The plan is for this ecosystem to enable public and private compliance officers to benefit from a better division of labor and leverage artificial intelligence tools to perform KYC more efficiently.

What are the macroeconomic implications of this payment innovation?

Stablecoins can enable more efficient remittances and settlements with their lower transaction costs and 24-7-365 uptime for their users. The volume of global cross-border payments was around US $156 trillion in 2022 with a projected compound annual growth of 5%. According to the World Bank, sending remittances costs a global average of 6.3% of the amount sent in 2022. Traditional banks remain the most expensive Money Transfer Operators (MTO) with an average cost of 11.69%. Mobile money remains the least costly both to send and receive remittances at 4.24% in Q3 2022.[3]

The point is, none of these bottlenecks apply for stablecoins running on decentralized ledgers, so the savings should be passed on to the consumer.

Further, in providing tokens that can serve as a digital medium of exchange, store of value, and unit of account, stablecoins are in effect, the currency of choice for the crypto industry. They are the most efficient “onramp” from legacy finance to the crypto industry. Traders involved with large volumes would not want to be paid in bank deposits because of the repeat compliance checks for every entry and exit from crypto space. It also helps traders and investors avoid some of the volatility of crypto assets while holding funds in token form. Finally, with their interoperability with various blockchains, stablecoins also enable crypto’s innovation potential such as smart self-executing contracts. These contracts enable new markets and services with applications like blockchain-based video streaming, next-generation microtransactions such as “streaming” money, and many other crypto financial innovations yet to come.

The elephant in the room: what is up with Tether?

The two stablecoins with the largest network effects are USDC and USDT. Their parent companies now enjoy significant first-mover advantages.

Tether (USDT) was the first stablecoin issuer. They are owned by iFinex[4] which also owns the crypto exchange platform BitFinex. According to Tether’s CTO Paulo Arduino, the original use case for Tether was to facilitate price arbitrage on Bitcoin given that it takes roughly ten minutes to issue a new block and propagate it across the network. A far cry from the grandiose libertarian vision they claim to aspire to today. Eventually, the crypto industry started relying on Tether given the need for transfer speeds between legacy and crypto finance. Today, Tether provides liquidity for the entire global crypto industry with tentacles in many markets and multiple fiat-currency-based tokens. Tether operates the Euro-pegged EURT, the offshore Renminbi-pegged CNHT, and they are working on launching a Peso-pegged token. Their largest token remains by far the US dollar-backed USDT.

The affiliation between Bitfinex (the exchange) and the coin issuer (Tether) was repeatedly denied by Tether and only revealed under duress after its settlement with the New York Attorney General. These sorts of glaring conflicts of interest are another warning about the potential for co-mingling customer funds in schemes designed to prop up one asset for another. Bitfinex exited the US market in 2018, ceding to the Coinbase/USDC alliance that went live in September 2018.[5] Tether claimed to focus on its competitive advantage in servicing emerging markets for harder currency. A perfectly valid explanation if it wasn’t for the almost unbelievable graph below. Figure 2 below shows a staggering growth rate of close to a thousand percent from $8 billion to ~$83 billion at the time of writing. Tether became the size of a small central bank in just three years.

Figure 2: USDT and USDC’s market capitalization | source: CoinMarketCap.com

Around December 2022, a sharp and ongoing divergence between USDT and USDC’s market capitalization becomes apparent. Part of the competition between USDT and USDC is based on credibility. However, the odd trend in this data is that up to this divergence, USDT’s reputation was significantly less favorable than USDC. USDC holds all of its reserves in separate accounts with US-regulated financial institutions (one of which, Silicon Valley Bank, failed spectacularly a few months ago) while USDT paid regulatory fines for misrepresenting their reserves and suffered theft from their treasury wallet. Today, serious questions remain about the composition of Tether’s reserves and their lack of audit by an independent entity.

The litmus test for USDT came after the collapse of LunaUSD caused a run on all digital assets. Tether’s price remained stable after some fluctuations. Similarly, after the collapse of FTX and capital flight with the failure of SVB, Tether CTO Arduino claimed they were able to redeem $7 billion in non-tokenized dollars in 48 hours (10% of their reserves) and thereby stabilize the token’s value. If that statement proves to be true, it would undoubtedly add trust that users’ digital coins will be redeemed for their underlying reference value. Then again, they could also just be minting USDT out of thin air. We don’t know because there is no independent verification of any of these claims. If it looks too good to be true, it usually is.[6]

The harder money vehicle for hyperinflationary local currencies

The CTO of Tether, Paulo Arduino believes Tether’s raison d’etre today is not to be the digital dollar for wall street, rather it is to fulfill the needs of emerging markets for harder currency. Today, Tether allegedly brings the greenback to places riddled with hyperinflation and imploding capital markets. Whenever foreign trade is still possible, a going concern would, in theory, be able transact with Tether without the local banking system stealing their “fresh dollars,” as they are referred to in Lebanon. Tether is also relevant wherever inflation is rampant enough to rob their citizens of their savings. Stablecoins have therefore unequivocally the most promise to increase dollar exports. Even Russian citizens can buy USDT today for a small premium.

Since every sign out there is pointing towards a Ponzi scheme in the case of Tether, and the majority of users of stablecoin today remain large institutional investors with demand for US dollars on the blockchain, it would be a tragic irony for people robbed of their local savings get robbed a second time if the house of cards comes crashing down.

The current chair of the Financial Services Committee Rep. Patrick McHenry (R-NC) has often alluded to stablecoins’ relevance to the international dollar. However, the 118th Congress has yet to seriously address the broader implications of backdoor dollarization through USDC and how to compete with the digital Euro in regions like West and Central Africa. Coming up next.

[1] At the risk of over-simplification, algorithmic stablecoins stabilize their price by the automatic buying and selling of an issued token against another governance token, while the collaterized type uses other cryptos as collateral. However, the experience of Terra Luna and others have shown that these algorithms quickly tend to zero when stressed from a supply-demand standpoint. While the underlying technology may show financial innovation promises, they are outside the scope of US policymakers’ deliberations, though they may occasionally be dragged into the conversation for political grandstanding or to suggest they should be banned altogether. Stablecoins can also operate on private blockchains for faster transfer and settlement of internal operations. These are typically run by coalitions of banks or behemoths like JP Morgan Chase’s JPM Coin and are also not relevant to this discussion.

[2] This part of Circle’s business model raises serious questions about the impact on the two-tiered banking system and is addressed in a paper by the Board of Governors of the Fed Discussion Paper. In it, the authors conclude that a framework of cash-equivalent securities held as reserve collaterals for stablecoins can be compatible with the two-tiered banking system for credit creation carrying no systemic risks or disintermediation of the banking sector.

[3] The composition of the transaction cost is a result of various backend processes required to complete a successful payment transfer. The fee charged by a traditional MTO like Western Union is used to fund its KYC compliance requirements, account for any incompatibilities in messaging standards, and a foreign exchange margin. Depending on the speed of the clearing process, fluctuating exchange rates can add a downstream bottleneck depending on the MTO’s policy on when to lock in a price ratio, especially when the market exchange rate varies significantly between the time a transaction is initiated and when it is settled.

[4] registered in the British Virgin Islands and Hong Kong

[5] Today US persons are restricted from using Tether unless they are registered as an Eligible Contract Participant, typically reserved for large institutional investors.

[6] Tether was fined and banned from doing business in New York in 2021. The New York AG investigating Tether stated: “Bitfinex and Tether recklessly and unlawfully covered-up massive financial losses to keep their scheme going and protect their bottom lines. Tether’s claims that its virtual currency was fully backed by US dollars at all times was a lie (…)”